Introduction: Why Private Credit Matters in 2025

In 2025, public market volatility, rising interest rates, and declining income from traditional assets are driving accredited investors and family offices in Singapore toward alternative income strategies.

Private credit - the practice of non-bank lenders issuing loans to companies, it has become a compelling solution due to its:

- Higher yields compared to public bonds

- Low correlation with stock markets

- Regular income via interest payments

As traditional bonds deliver modest returns and equity markets remain uncertain, private credit is becoming a mainstream allocation for building resilient portfolios.

This guide offers a comprehensive exploration of private credit investing in Singapore, including:

- What private credit is and how it differs from traditional debt

- Why it has grown rapidly

- How investors can participate under Monetary Authority of Singapore (MAS) regulations

- Strategy types, risks, and emerging structures such as:

- MAS’s new LIF framework

- Platform innovations like Kilde

By the end, you’ll understand how private credit provides steady income, diversification, and a clear path to investment in 2025.

What Is Private Credit? Definition, Meaning, and Examples

What Is Private Credit?

Private credit refers to debt financing provided by non-bank lenders through privately negotiated loans. In simple terms, it involves investors (via funds or platforms) lending money to businesses without using the public bond markets.

These loans are not traded on exchanges; instead, they are custom agreements designed to meet a borrower’s specific needs.

For example, a private credit fund might lend S$50 million to a mid-sized Singaporean company for expansion, secured by the company’s assets. The deal is arranged privately with terms negotiated between the lender and the borrower.

In return for accepting the illiquidity and higher risk of these loans, investors receive higher interest rates - commonly referred to as the illiquidity premium.

Key Features of Private Credit

Illiquidity

Private credit investments often have lock-up periods of 1–5+ years. Investors accept this limited liquidity in exchange for higher yields.

Bespoke Structures

Loans are customised in terms of maturity, covenants, collateral, and amortisation - unlike public bonds, which have standard terms.

Direct Relationship

Deals involve a direct lender-borrower relationship, often intermediated by a fund or platform. There’s no public market setting prices; terms are negotiated one-on-one.

Floating Rates

Most private credit loans use floating interest rates, often pegged to benchmarks like SORA or SOFR plus a spread. This provides a hedge against inflation or central bank rate hikes.

Collateral & Covenants

Many loans are secured by assets such as property, inventory, or receivables. They include protective covenants to safeguard lenders, enhancing recovery prospects in case of borrower default.

Where Private Credit Sits

Private credit occupies a space between traditional bank loans and public bond markets. It's especially useful for companies too small or complex for public bond issuance.

In Singapore, private credit frequently finances:

- Real estate development

- Mid-market corporate growth

- Consumer and SME lending (via fintech platforms)

- Infrastructure projects

Despite deal diversity, all share the defining traits of being private, customised, and illiquid.

{{cta-component}}

Public Credit vs Private Credit

Table: Public vs. Private Credit – key differences in liquidity, issuers, and yields.

Examples of Private Credit Deals

Private credit encompasses a wide variety of deal types, including:

Unitranche Loan

A single debt instrument combining senior and junior debt, often extended to fast-growing companies such as tech startups.

Mezzanine Financing

Subordinated debt provided to family-owned or mid-market businesses, typically with equity warrants attached for upside participation.

Real Estate Bridge Loans

Short-term financing for property developers, used to cover gaps before longer-term financing or asset sales.

Asset-Based Loans

Loans secured by specific collateral such as receivables or inventory, often used by trading or logistics firms.

These are not publicly listed instruments like bonds on the SGX. They are private agreements available only to select, usually accredited, investors.

Private Credit vs. Private Debt: Are They the Same?

You’ll often encounter the terms private credit and private debt, alongside others like alternative credit or direct lending.

For most purposes, these are used interchangeably - there's no rigid distinction. Both refer to debt investments that are not publicly traded.

General Usage

Private Credit

Often refers to the overall asset class or strategy of lending through privately arranged deals.

Example: An investment firm might say, “We manage a private credit fund,” meaning a fund that provides private loans.

Private Debt

Can refer to the actual instruments (e.g., the loans or notes). It’s also a general term for the asset class.

Example: Industry data providers like Preqin use “private debt” in their AUM statistics.

Conceptual Difference (If Any)

- Private Credit emphasises the act of lending or credit provision.

- Private Debt emphasises the debt instruments themselves.

However, in practice, there’s no meaningful difference. Whether someone says “private credit fund” or “private debt fund,” they’re talking about a fund that provides privately negotiated loans.

Insider Nuance

Sometimes, industry professionals might distinguish the two slightly:

Still, the overlap is substantial. For accredited investors in Singapore, there’s no need to stress over the semantics. Both terms describe private lending as an alternative to public bond investments - aimed at earning higher returns.

Global and Asian Private Credit Market Overview

Over the past decade, private credit has evolved from a niche segment into a major asset class.

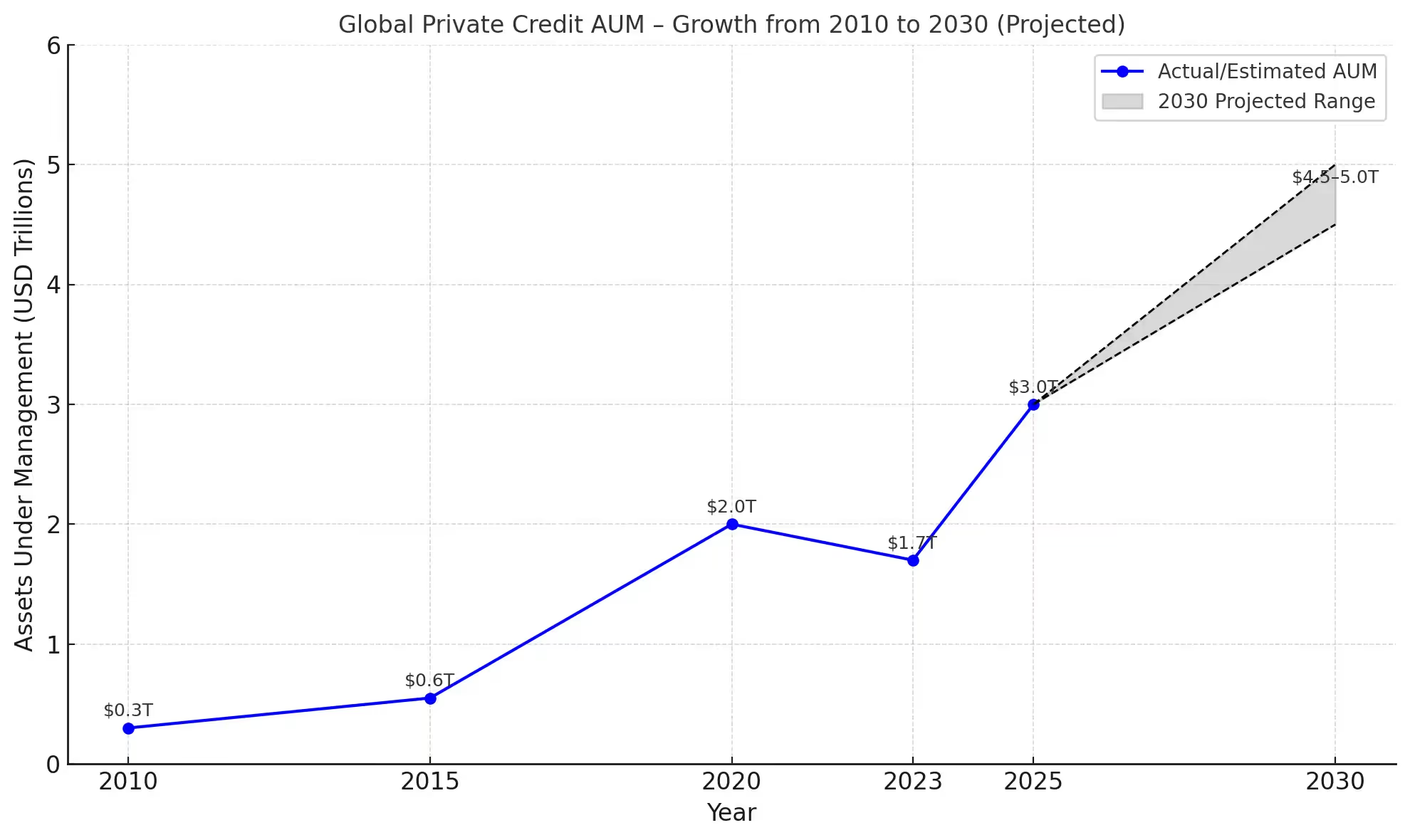

Back in 2010, total global private credit assets under management (AUM) stood at approximately $300 billion.

The turning point came during the 2008–2009 financial crisis: as banks retreated from lending, private funds filled the gap. This sparked exponential growth.

By 2025, global private credit AUM has surpassed $3 trillion. Major institutional investors — pension funds, sovereign wealth funds, and endowments — have entered the space in search of attractive, stable returns.

Global Private Credit AUM Growth (2010–2030)

Drivers of Global Growth

- Bank Lending Pullback - Stricter post-crisis regulations (e.g., Basel III) reduced bank lending to mid-sized firms, creating a funding gap.

- Search for Yield - Persistently low interest rates in the 2010s led institutional investors to seek higher returns through private debt.

- Resilience During Volatility - Events like the COVID-19 shock showcased private credit’s strengths - closed-end structures shielded it from forced selling, and many loans were restructured privately, avoiding public market panic.

Asia’s Emerging Role in Private Credit

Initially concentrated in the U.S. and Europe, private credit is now gaining serious momentum in Asia.

Key Highlights:

Singapore and Australia

Early adopters in Asia-Pacific. Singapore in particular has seen an uptick in fund launches due to favorable regulation.

MAS Support

The Monetary Authority of Singapore (MAS) actively promoted private credit by inviting global managers via initiatives like the Private Markets Programme. This positioned Singapore as a regional hub.

Deal Flow

By 2025, Southeast Asia is experiencing rising deal volume.

Example: A $200M mezzanine loan for a renewable project in Indonesia arranged by a Singapore-based fund.

Example: Growth capital from Singapore fund managers to Indian tech companies.

Investor Demand

Asian pension and insurance funds, traditionally bond-focused, are now turning to private credit for diversification and yield. Many are allocating through Singapore-based vehicles.

Singapore's Role in 2025

Singapore is firmly established as the Asian epicenter of private credit, with an ecosystem that includes:

- Global and regional fund managers (e.g., KKR, BlackRock, Temasek-linked entities)

- Digital platforms (e.g., Kilde)

- Advisors and legal firms

- Regulators (e.g., MAS) that support innovation and responsible growth

{{cta-component}}

Why Investors Are Turning to Private Credit

Why allocate to private credit? In one word: advantage - in yield, income stability, and portfolio diversification.

Especially in today’s rate-sensitive environment, private credit offers compelling benefits hard to replicate in traditional fixed-income or equity markets.

Higher Yields and Steady Income

The headline appeal is clear: superior yield. Private credit has historically delivered higher returns than public fixed-income markets.

- Yield Comparison (2023):

- Private credit funds: ~10–12%

- High-yield bonds: ~7–8%

- Yield Spread (2025):

- Average private credit yield: ~10.15%

- Comparable B-rated public loans: ~7.85%

- Spread advantage: +2.3 percentage points

This yield premium is driven by two factors:

- Credit Risk Premium: Lending to smaller or unrated borrowers who don't qualify for public markets.

- Illiquidity Premium: Compensation for locking up capital over multi-year loan terms.

For income-focused investors, the difference is meaningful. Earning 10% instead of 4% (typical bond yield a few years ago) can transform cash flow planning, especially for retirees or family offices.

Regular Cash Flow

Private loans often pay monthly or quarterly interest, making them ideal for:

- Meeting lifestyle expenses

- Covering liabilities

- Planning stable income streams

This creates a “high-yield coupon machine” effect. In fact, many family offices in Singapore use private credit allocations specifically to generate predictable cash flows - often exceeding those from rental properties or dividend stocks.

Case Comparison: Private Credit vs Traditional Income Assets

The ability to beat inflation while generating stable income makes private credit an increasingly attractive asset class - especially for accredited investors seeking yield resilience in 2025.

Portfolio Diversification and Low Correlation

Private credit enhances portfolio diversification by offering a return stream that is less sensitive to daily market swings. Returns are primarily driven by individual borrower performance — idiosyncratic credit events — rather than broad market sentiment.

Since these loans aren’t traded on public markets, they are not marked-to-market daily, which reduces volatility and shields investors from short-term price swings.

Stability During Market Stress

- Private credit loans are not subject to panic selling.

- Valuations are based on underlying borrower fundamentals, not market pricing.

- This structure leads to slower, more deliberate price adjustments during downturns.

COVID-19 Case Study:

Private credit managers often restructured or extended loans instead of being forced to sell — reducing realised losses.

Low Correlation With Public Markets

Historically, senior direct lending and other private credit strategies show low correlation to:

- Public equities

- Public fixed income (bonds, ETFs)

Adding private credit to a portfolio has been shown to improve the Sharpe ratio — meaning higher returns for the same level of risk.

Resilience Across Economic Cycles

Private credit can perform under various conditions:

- Growth periods: Borrowers perform well, loans repay, and yields are realised.

- Flat/mild recessions: Some defaults occur, but active management (e.g., restructuring, sponsor support) can preserve value.

- Severe recessions: Risks increase (detailed later), but downside is actively managed—not passively absorbed like in bond funds.

Diversification Benefits for Singapore Investors

For Singaporean accredited investors with portfolios concentrated in local equities, real estate, SG bonds or cash adding private credit offers:

- Exposure to global borrowers and sectors

- Reduced mark-to-market volatility

- Smoother portfolio performance across quarters

While the pricing noise disappears, the underlying risks still exist - they’re just not visible in daily fluctuations. This can reduce emotional decision-making and improve long-term investing discipline.

Downside Protection and Resilience

Despite lending to non-public, sometimes riskier borrowers, private credit offers several built-in structural protections that can help mitigate losses during downturns.

Collateralized Lending

- Senior Secured Positioning - Many private credit loans are senior secured, meaning lenders have first claim on specified collateral:

- Real estate

- Equipment

- Share pledges or business assets

- Recovery Advantage - If a borrower defaults, lenders can seize and liquidate assets. In contrast, public corporate bonds are often unsecured and recover only after banks and secured creditors are paid.

Result: Higher recovery rates for private credit investors.

Protective Covenants

Private loans frequently include maintenance covenants such as:

- Debt-to-EBITDA limits

- Interest coverage minimums

Benefits of covenants:

- Allow lenders to intervene early if a borrower’s financials deteriorate

- Enable renegotiation of terms, rate hikes, partial repayment, or asset sales

- Help prevent minor issues from becoming major defaults

By contrast, many public high-yield bonds have become “covenant-lite,” reducing investor protections.

Historical Loss Rates

Private credit has recorded lower loss ratios than high-yield bonds over time due to:

- Collateral-backed structures

- Active monitoring

- Controlled, bilateral restructuring processes

Rather than navigating complex, public bankruptcy proceedings, private lenders can work directly with borrowers—often leading to smoother recovery outcomes and better principal preservation.

Flexibility During Distress

One of private credit’s biggest advantages is flexibility in distressed situations:

- Direct relationships allow lenders to amend terms, provide rescue capital, or negotiate equity stakes

- Helps avoid fire-sale liquidations or mass defaults

Example Scenario:

If a borrower underperforms:

- The lender may waive a covenant in exchange for:

- Additional collateral

- Equity issuance

- Higher interest margin

- This gives the company time to recover and repay - whereas public bondholders might be forced into permanent loss after a single missed payment

Risk-Reward Profile

While private credit isn’t risk-free (see next section on risks), these structural features — collateral, covenants, direct oversight, and flexibility — meaningfully enhance its downside protection.

Floating Rate Structure – An Inflation Hedge

A key feature of private credit is its floating interest rate structure, which provides a natural hedge against inflation and rising interest rates.

How It Works

Most private credit loans reset periodically based on short-term benchmarks, typically:

- SORA (Singapore Overnight Rate Average)

- SOFR (Secured Overnight Financing Rate)

Loan pricing examples:

- SORA + 6%

- SOFR + 550 bps, often with a rate floor

As central bank rates rise, the reference rate rises - automatically increasing the coupon for investors.

Real-World Yield Escalation

Example: A direct loan issued in early 2022 at 8% would yield over 12% by 2023 as SOFR climbed.

Outcome: Income grows with rising rates, unlike fixed-rate bonds that drop in value.

Inflation Protection

This structure allows private credit returns to:

- Adjust with interest rate cycles

- Preserve real returns during inflationary periods

- Compete with (and often outperform) inflation-linked securities

Resilience During Rate Hikes

During the 2022–2023 global rate tightening, investors did not pull out of private credit. In fact:

- AUM increased, as floating-rate income became more attractive

- Private credit outperformed many fixed-income instruments

Many funds now market themselves as offering “Inflation-resistant income with yield stability”

This floating-rate feature is a core differentiator that enhances the appeal of private credit in a high-rate world.

Shorter J-Curve and Quicker Capital Return

Compared to private equity, private credit offers a faster return profile and a shorter J-curve—meaning investors begin receiving income sooner, with less initial performance drag.

Shorter Capital Deployment Timeline

- Private Equity: Capital is drawn down over 3–5 years. Returns are typically realised years later upon exits, resulting in a long initial dip in returns (the “J-curve”).

- Private Credit: Capital is deployed immediately into loans that start paying interest. Most funds begin distributions within 6–12 months.

Faster Capital Recycle

- Loans usually have maturities of 2–5 years

- Borrowers repay principal via amortisation or bullet repayment

- Some direct lending funds self-liquidate by year 6–7, enabling reinvestment

Investors gain flexibility to redeploy capital earlier—unlike PE funds that may lock capital for a decade.

Balanced Return Profile

Private credit blends income and capital preservation:

- Yield: High single to low double digits

- Income: Regular coupons (monthly or quarterly)

- Risk: Lower volatility vs. equities, with structured protections

Positioned between bonds and equities on the risk/return spectrum, it provides equity-like returns with bond-like stability.

Why It Appeals to Singapore Investors

Accredited investors in Singapore increasingly allocate to private credit to:

- Build income resilience

- Diversify away from local stocks and property

- Preserve capital while earning premium yields

Comparative Asset Class Table

Table: Comparing Private Credit’s profile to other assets. Indicative yields as of 2025.

Private credit stands out for yield and stability, with the primary trade-off being illiquidity. For investors willing to lock up capital, the payoff has historically justified the risk - provided due diligence is done.

Next: understanding strategies and risks in more detail.

{{cta-component}}

Private Credit Strategies: Types, Risk, and Return Spectrum

Private credit includes a wide variety of lending strategies. Each strategy carries different risk-return profiles and portfolio roles.

Below is a refined summary of the key strategy types without duplicating what's already covered in the comparative table.

Strategy Overview

Private credit is not a monolithic asset class - it spans a spectrum from lower-risk senior loans to high-risk distressed opportunities.

Key categories include:

Senior Direct Lending

Core of the asset class. First-lien loans to mid-sized companies, often secured and floating-rate. Typical returns: ~8–10%.

Unitranche Loans

Blends senior and subordinated debt into a single loan. Common in sponsor-backed deals. Typical returns: ~10–12%.

Mezzanine Debt

Subordinated debt, usually unsecured but with equity kickers (warrants or convertibles). Higher yield (~12–18%) with elevated risk.

Venture Debt

Issued to VC-backed startups. Risky due to lack of cash flow; returns include interest (~10–15%) plus equity upside.

Distressed Debt

Buying debt of troubled companies or providing rescue capital. Target returns can exceed 20%, but with high volatility and legal complexity.

Asset-Based Finance (ABF)

Lending backed by tangible assets like receivables, equipment, or inventory. Shorter terms, self-liquidating structures. Returns: ~6–12%.

Real Estate Debt

Loans for development, acquisition, or refinancing of properties. Common in Singapore and Asia. Yields range ~8–15% depending on seniority.

Infrastructure Debt

Financing stable, long-duration projects like renewable energy or data centers. Senior tranches offer modest returns (~5–10%), higher if subordinated.

Specialty Finance

Lending to fintechs or non-bank lenders, often via warehouse lines secured by loan pools. Returns: ~8–14%.

Structured Credit

Investments in CLOs or asset-backed securities (ABS). High complexity, high potential yield (10–20%), but tied to macro credit trends.

Strategy Comparison Table

Practical Notes for Singapore Investors

- Common Allocations: Senior direct lending, real estate debt, and specialty finance.

- Less Common: CLOs, distressed debt - usually accessed through global or institutional funds.

- Fund Design: Many funds specialise in a single strategy; others are multi-strategy with dynamic allocation.

- Risk Matching:

- Lower volatility, stable income: stick with senior loans, ABF.

- Higher return appetite: add mezzanine or opportunistic slices.

- Long-term diversification: include infra debt or venture slices in small doses.

As with equities, diversification across private credit subtypes improves portfolio resilience.

Strategy-specific due diligence is essential to ensure you understand the yield sources and embedded risks.

Warehouse-Structured Private Credit & Bankruptcy-Remote SPVs

Private credit isn’t limited to direct loans to companies. A growing segment—especially in consumer, SME, and fintech lending—is structured through “warehouse” funds that operate via bankruptcy-remote SPVs (Special Purpose Vehicles).

This model, increasingly seen in Singapore through platforms like Kilde, offers scalability, diversification, and enhanced legal protection.

How It Works

- Loan Origination: Instead of the fund directly issuing large corporate loans, third-party originators (like fintech lenders or non-bank financial institutions) make thousands of small loans to end-borrowers (e.g., consumers or SMEs).

- SPV Structure: A private credit fund or affiliated vehicle provides funding by purchasing these loans or financing them via a revolving facility. Crucially, these assets are housed in a bankruptcy-remote SPV—a legally separate entity with independent trustees and governance.

- Investor Role: Investors lend to or invest in the SPV. Their returns come from the aggregated interest and principal payments from the underlying loan pool.

- Why SPVs?

- Legal Protection: Assets in the SPV are legally separate from the originator. If the originator fails, creditors cannot seize the SPV’s assets—investor capital remains shielded.

- Governance: Independent trustees and fund managers oversee performance triggers, covenants, and underwriting discipline. This adds a second layer of risk control beyond the originator.

Advantages of the Warehouse Model

This approach allows investors to access granular, well-diversified credit exposure without being overly exposed to any single obligor.

Comparing Models: Direct Lending vs. Warehouse SPVs

Case Example: Kilde’s Warehouse Model in Action

Kilde is a Singapore-based digital private credit platform using the SPV model:

- Loan Sourcing: Kilde partners with vetted originators (e.g., last-mile lenders, SME fintechs).

- Asset Control: Loans are held in bankruptcy-remote SPVs administered by independent trustees.

- Investor Funds: Capital flows through escrow accounts at DBS Bank—Kilde never touches investor money directly.

- Returns & Risk: The model has achieved a 0% default track record to date, due to tight underwriting, asset backing, and diversification. That said, credit risk remains and must be evaluated case-by-case.

This structure enables Singapore investors to access high-yield loans — e.g., car loans in Indonesia or working capital to Indian retailers — without direct exposure to the originators.

{{cta-component}}

Final Thoughts

Warehouse SPVs represent a modern evolution in private credit, enabling:

- Broader access to underbanked markets

- Higher transparency and risk mitigation through structural safeguards

- Exposure to scaled loan portfolios previously inaccessible to individual investors

It’s a high-diversification, high-yield model that aligns particularly well with accredited investors in Singapore seeking income and resilience beyond traditional fixed income. As always, investor diligence must include not only the fund but also the originators, underwriting practices, and legal structure.

Next up: we’ll discuss how investors can assess and select private credit funds - what questions to ask, what risks to evaluate, and how to build a balanced private credit portfolio.

Who Can Invest in Private Credit in Singapore?

Private credit is attractive, but access isn’t universal.

MAS restricts most of the asset class to Accredited and Institutional Investors. Retail investors have limited exposure, though that’s changing. Let’s break down investor categories and what each can (or can’t) do.

Accredited Investors (AIs)

MAS defines AIs using any one of these thresholds:

- Net personal assets > S$2 million, of which only S$1 million from your primary residence counts.

- Income > S$300,000 over the past 12 months.

- Net financial assets > S$1 million, including up to S$200,000 in crypto (after 50% haircut).

Once certified (via opt-in), you get full access to:

- Private credit funds (local and offshore) with minimums of ~$100k–$500k.

- Digital platforms like Kilde or StashAway Reserve, offering curated deals (some as low as ~$10k).

- Club deals, co-investments, or direct lending, often through family office networks.

Tradeoff: You give up some investor protection - no suitability requirements, fewer disclosures. Due diligence becomes your responsibility.

Common setups:

- Joint accounts: One spouse qualifies, both can invest.

- Trusts & family investment companies: Qualify if assets > S$10M.

With property prices high, thousands of Singaporeans meet the AI threshold. If you are one—and opt in—you’re eligible for the full private credit universe.

Institutional Investors

Includes insurers, pension funds, sovereigns (e.g., GIC, Temasek), large corporates, and regulated entities. These investors have unrestricted access and are typically the largest allocators.

Use cases include:

- Committing anchor capital to funds (with preferential fees/terms).

- Running managed accounts or building in-house credit teams (e.g., family offices).

- Accessing secondary markets for private credit (buying existing fund stakes).

Institutions often allocate via:

- Fund mandates (e.g., $50M to an Asia direct lending fund).

- Club deals or co-lending with banks on infrastructure loans.

- Section 13U/13O funds for tailored family office strategies.

No legal limitations exist - access depends only on scale and expertise.

Retail Investors

Currently restricted. Retail (non-AI) investors cannot access most private credit vehicles.

You’re blocked from:

- Private placements

- Exempt offerings

- Institutional-only funds or platforms

Limited existing options:

- P2P Lending Platforms: e.g., Funding Societies. Accessible but high-risk. You fund unsecured SME loans, often with minimal credit protection.

- Listed BDCs or bond ETFs: Indirect exposure through public markets (U.S. BDCs or high-yield ETFs), not “true” private credit.

- Bond funds with private allocations: Very minor allocation in some unit trusts.

BUT: That’s Changing — The LIF Framework

MAS proposed the Long-Term Investment Fund (LIF) model in 2025 to give retail investors exposure to private markets (including private credit).

Expected Features:

- Diversified portfolios (fund-of-funds) with 20–40% in illiquid assets (e.g., private credit, VC, PE).

- Liquidity: Periodic (e.g., quarterly) but limited.

- Lower investment minimums (~S$1,000–S$10,000).

- Heavier disclosure and investor protection.

As of Nov 2025: LIFs are not live yet, but the first products may roll out in 2026. MAS aims to balance access with risk containment.

Foreign Investors

Foreigners can invest, but only if they qualify as Accredited (based on local or Singapore-equivalent criteria). Most SG-domiciled funds are offered as “restricted schemes,” requiring AI status—regardless of nationality.

Tax angle:

- No capital gains tax in SG.

- No withholding tax on fund distributions if structured correctly (e.g., via QDS or VCC schemes).

- 15% withholding tax applies if a foreigner lends directly to a Singapore borrower—so funds/SPVs are the standard route.

There’s no legal restriction on foreign ownership or lending. But if a foreigner lends regularly onshore, they must avoid being classified under the Moneylenders Act - this is generally not an issue via funds.

Summary Table – Access to Private Credit in Singapore

Key Takeaways

- Accredited investors and institutions dominate the space. If you’re AI-qualified, this guide’s content fully applies to you.

- Retail access is limited today but will broaden once the LIF structure launches.

- Foreign investors can participate if they meet AI thresholds and structure around tax efficiently.

Up next: we’ll cover how to actually invest in private credit — step-by-step — from onboarding to deal selection to risk analysis.

Because access is just the beginning. Execution matters.

{{cta-component}}

How to Invest in Private Credit (Step-by-Step)

Investing in private credit isn’t as straightforward as buying stocks, but it's not as opaque as it might seem. If you break it down into clear steps, it's a navigable process - even for newcomers with the right guidance. Here’s a practical roadmap from eligibility to execution and beyond.

Step 1: Confirm Eligibility and Define Your Allocation

Private credit is largely limited to Accredited Investors (AIs) in Singapore. Ensure you qualify:

MAS AI Criteria (any one of the following):

- Net personal assets > S$2M (only S$1M from your home counts).

- Income > S$300K in the past 12 months.

- Net financial assets > S$1M (including crypto under haircut rules).

You'll need supporting documents (e.g., tax statements, CPF/CDP balances). Most platforms support Singpass/MyInfo integration to speed up verification.

Set your capital allocation and horizon upfront. Example: “I’ll allocate S$250k across 5 years — 10% of my portfolio.” This discipline will drive your product selection and risk tolerance.

Step 2: Choose Your Investment Route

A. Digital Platforms (e.g., Kilde, StashAway Reserve)

- MAS-licensed platforms offering pre-vetted private credit notes or portfolios.

- Kilde allows direct investments in individual deals from ~US$5K, with full deal documentation.

- StashAway Reserve offers a managed allocation via private credit fund portfolios—less granular but more turnkey.

Great for: hands-on investors seeking deal-level control or cost-effective diversification.

B. Private Credit Funds via Banks or Advisors

- Access to global and regional credit funds through private banks or IFAs.

- Typical ticket sizes: US$100K–$500K (some feeders accept less).

- Hands-off structure with diversified exposure and professional management.

- Expect 5–7 year lockups and capital calls.

Great for: passive investors seeking broad exposure via professionals.

C. Direct Deals / Co-Investments

- Via family offices, angel groups, or boutique firms.

- High touch, high risk: you underwrite the borrower (e.g., lend $1M to a firm).

- Suited only for experienced investors with deep diligence capability.

D. Specialised or Tokenised Products

- Includes niche structures like trade finance funds or tokenised loan participations.

- Still emerging and often illiquid; regulatory clarity is evolving.

Step 3: Perform Due Diligence

If using platforms like Kilde:

- Scrutinise the borrower or originator—reputation, regulatory standing, loan history.

- Analyse collateral (receivables, real estate, etc.) and Loan-to-Value (LTV) ratios.

- Note repayment terms (bullet vs. amortising), tenor, and enhancements (e.g., overcollateralization).

- Review jurisdictional/currency risk if investing outside SGD.

- Examine default history and stress scenarios—even if platform claims 0 defaults.

If using funds:

- Vet the fund manager—track record, team depth, and past fund performance.

- Understand the strategy—senior lending vs. mezzanine, geographic and sectoral spread.

- Check fund terms—fees (2/20 is standard), GP co-investment, fund leverage.

- Clarify liquidity—closed-end vs. open-end, redemption gates, NAV calculation frequency.

Tax & currency:

Most SG-based funds/platforms are structured tax efficiently. Avoid surprises by checking if you're exposed to withholding tax (e.g., 15% on U.S. source interest) or FX risk.

Step 4: Execute the Investment

On Platforms:

- Upload documents → KYC → sign electronically → transfer funds to escrow.

- Receive contract notes and interest payments (usually monthly/quarterly).

- Monitor maturity and reinvestment options via dashboard.

In Funds:

- Complete subscription paperwork (often 50+ pages, including FATCA/AML).

- Commit capital, then respond to capital calls over 1–2 years.

- Receive distributions as loans repay; track IRR via quarterly reports.

- Missing capital calls can result in severe penalties—keep liquidity ready.

Step 5: Diversify and Rebalance

- Platforms: spread across multiple notes, sectors, and maturities (e.g., 5 x S$40K vs. 1 x S$200K).

- Funds: consider multiple managers or strategies (e.g., Asia vs. US, senior vs. mezzanine).

- Reinvest vs. Withdraw: if cash flow isn’t needed, reinvesting compounding interest boosts long-term returns.

- Periodically assess performance and reallocate based on macro trends (e.g., move toward senior secured loans in downturns).

Step 6: Use Professional Help Where Needed

- Consider third-party due diligence firms or independent advisors.

- Platforms like Kilde provide extensive info, but you’re still the final decision-maker.

- Private banks and wealth managers can provide access, structuring advice, and legal support.

Red flag: If something is too opaque or lacks detail - walk away or seek clarity. Transparency and manager alignment (e.g., skin in the game) are key to protection.

Summary Pathway

Private credit isn’t plug-and-play, but it doesn’t need to be intimidating. With rising platforms and institutional quality offerings, more investors than ever are accessing this space efficiently. The illiquidity is real - but so are the returns.

Next: we’ll examine how private credit funds and deals are structured in Singapore, and how that affects tax, compliance, and investor protections. This gets into the legal plumbing - but it's essential for getting your net returns right.

Tax, Regulation, and Structuring: MAS, IRAS, and the VCC

Private credit doesn’t operate in a vacuum - it’s shaped by Singapore’s regulatory and tax frameworks.

Fortunately, Singapore has built a uniquely attractive infrastructure for private credit, combining robust oversight with investor-friendly structures like the Variable Capital Company (VCC). Let’s break it down.

Regulatory Landscape: MAS and Legal Oversight

Singapore doesn’t have a “Private Credit Act” per se. Instead, the sector is governed under existing regulations that ensure all players are properly licensed and accountable.

Fund Managers: Capital Markets Services License (CMS)

Any manager investing on behalf of others in loans or securities must be licensed by the MAS.

Most private credit funds operate under a CMS license (or RFMC for smaller shops). For instance, firms like SeaTown or Azalea operate credit funds under this regime.

Platforms like Kilde also hold CMS licenses for dealing in securities. Licensing enforces standards around qualifications, audits, capital adequacy, and compliance.

Investment Offerings: Exemptions Under the Securities and Futures Act (SFA)

Private credit products are typically offered to Accredited Investors under exemptions (Sections 274/275 of the SFA).

This means no prospectus or MAS pre-approval is needed, though documentation clearly discloses this exemption.

Retail offerings require full prospectuses and MAS approval, which is costly and uncommon - this is expected to change with the Limited Investor Framework (LIF), but for now, retail remains excluded.

Lending Activity: No Need for Moneylender Licenses

Lending to businesses doesn’t require a moneylender’s license, provided the entity isn't engaged in consumer lending.

Funds and corporates lending to SMEs fall under commercial exemptions.

MAS does monitor lending activity that could reach retail (like P2P platforms), and imposes rules such as investment caps and disclosure requirements in those cases.

Financial Advice: FA Licensing

Anyone advising on private credit investments — banks, wealth managers, platforms — must be licensed or exempt under the Financial Advisers Act.

While AIs can waive suitability checks, regulated advice is still required.

Systemic Oversight

MAS monitors the growth of private credit, especially for signs of systemic risk, and has taken a collaborative stance - encouraging development with safeguards, rather than imposing heavy restrictions (unlike some Western regulators).

Variable Capital Company (VCC): Singapore’s Competitive Edge

Launched in 2020, the VCC is a fund structure purpose-built to attract asset managers to Singapore - and it’s become the default vehicle for many private credit funds.

Key Benefits of VCCs:

- Flexible Capital: VCCs can issue/redeem shares without complex capital rules. Perfect for distributing returns or managing investor flows.

- Multi-Strategy Setup: A single umbrella VCC can host multiple sub-funds (e.g., a private credit fund and a private equity fund), each legally ring-fenced.

- Privacy: Unlike regular companies, VCCs don’t disclose shareholder identities publicly—appealing to HNW investors.

- Regulated: Only MAS-licensed managers can run VCCs, ensuring governance and compliance.

For investors, VCCs provide an efficient and secure structure with professional-grade oversight.

Expect most new private credit funds in Singapore to be VCC-based going forward.

Taxation: Efficient, Low-Drag Returns

One of Singapore’s biggest strengths is the tax efficiency it offers both funds and investors.

Capital Gains

No capital gains tax. If a fund exits a loan at a profit, that gain is tax-free for the fund and investors.

Interest Income

Interest income from private credit is technically taxable for individuals—but not if it’s channelled through a compliant fund. Most funds are structured to shield investors:

- Income is accumulated within the fund or paid out as capital distributions.

- Structured vehicles avoid treating returns as direct personal income.

Withholding Tax (WHT)

Singapore imposes 15% WHT on interest paid to foreign investors - but this is usually avoided:

- Many funds lend offshore to offshore or through structures that bypass WHT.

- Some deals qualify for Qualifying Debt Securities (QDS) status - allowing 0% WHT for foreign holders, though this is more common for larger or listed bond structures.

Fund Tax Exemptions: Sections 13O and 13U

These are crucial frameworks that make private credit funds tax-neutral:

Funds structured under these are exempt from corporate tax and can pass income to investors with no additional Singapore tax.

Most VCCs apply for and receive these exemptions.

GST and Expense Relief

Approved funds under 13O/13U enjoy GST remissions—lowering fund operating costs and preserving investor yield.

Tax for Investors

- Singapore Residents: No tax on capital distributions from approved funds. Returns are treated as exempt income.

- Foreign Investors: No WHT on distributions from Singapore VCCs. Local tax only applies if returns flow directly (rare).

- Edge Case: US investors may be subject to PFIC rules and should seek tax counsel.

Example Scenario:

You invest S$100K into a VCC private credit fund yielding 10% gross. With a 1% management fee, your net is 9%. The fund is exempt under 13O. Your payout of S$9K annually is not taxed in Singapore.

Compare that to direct lending or a fund in a high-tax jurisdiction - you could lose 15–30% of yield to tax drag. Over a decade, the difference is substantial.

Legal Structuring: Strong Contracts, Enforceability, and SPV Use

- Governing Law: Most deals are under Singapore or English law - well-tested in courts and arbitration.

- SPVs: Common in note issuances - often domiciled offshore (e.g., Cayman), but listed as restricted schemes on MAS’s CISNet.

Example: Kilde’s SPVs are registered under this compliant format. - Bankruptcy Remote: SPVs protect investor capital from fund/operator insolvency.

Takeaway: Singapore Is a Global Leader for Private Credit Structuring

In short, Singapore has built a near-optimal environment for private credit investing: strong governance, tax efficiency, and flexible structuring. For Accredited Investors, that translates to higher net yields with robust oversight.

Next up: the risks - because while private credit delivers attractive returns, it’s not risk-free. Let’s look at what can go wrong and how to manage it.

Risks and Risk Management in Private Credit

Private credit offers attractive yield and diversification, but it is not without its risks. These risks are fundamentally different from those in traditional public markets, and managing them requires awareness, discipline, and alignment with skilled managers.

Here's a breakdown of the key risks and how they can be effectively mitigated:

Illiquidity Risk

The Risk: Private credit is inherently illiquid. Loans are not publicly traded, and most fund structures do not offer daily or even monthly redemption. Investors are typically locked in for the term of the fund or note - ranging from 1 to 7+ years. If you need to exit early, it may require a buyer to be found at a discount, or you might forfeit accrued interest.

Management:

- Only commit long-term capital. This is not for your emergency fund or short-term goals.

- Ladder maturities (e.g., allocate across 1-, 2-, and 3-year instruments) to create staggered liquidity points.

- Use diversified portfolio allocations, keeping liquid public assets in reserve.

- Platforms like Kilde sometimes offer early exit mechanisms, but these are not guaranteed and may involve penalties.

- Treat it as a hold-to-maturity asset, and if you can’t, reconsider your allocation size.

Perspective: Ironically, illiquidity can be protective - investors can't rush to redeem during a panic, reducing forced selling and value destruction, unlike mutual funds.

Credit (Default) Risk

The Risk: Private credit targets borrowers outside the investment-grade spectrum - SMEs, growth-stage firms, or niche sectors. Defaults do happen. Loss severity depends on recovery rates, legal protections, and portfolio concentration.

Management:

- Rigorous underwriting. Strong managers vet borrowers deeply. Kilde’s 0% default rate to date, for example, is a result of tight credit filters.

- Diversification. Avoid overexposure to any single loan, borrower, or sector. A fund of 50+ loans mitigates the damage of any single default.

- Secured lending. Prefer senior, asset-backed loans. Collateral improves recovery rates (historically 60–80% vs. 30–50% for unsecured).

- Covenants and monitoring. Financial triggers like debt-to-EBITDA ratios give early warnings. Lenders can then step in proactively.

- Workout expertise. Top-tier funds have internal teams or external partners to restructure troubled loans and salvage value.

- Structural buffers. Look for deals with subordination or first-loss protection, especially in platform and structured deals.

Benchmark: A 2–3% annual default rate is not unusual in private credit. It’s the loss after recovery that matters - often net losses are under 1% if managed well.

Valuation and Transparency Risk

The Risk: Private credit lacks real-time market pricing. Most funds value loans quarterly using internal models. This may smooth volatility but can delay recognition of problems. Transparency also varies - some funds disclose little about underlying positions.

Management:

- Trustworthy managers. Choose managers known for conservative valuation practices, not just performance.

- Independent valuation. Quality funds periodically engage third-party valuation firms, especially for open-end vehicles.

- Disclosure standards. Favour platforms or funds that offer detailed reporting—sector breakdowns, credit metrics, and updates on material events.

- Side letters. Larger investors can negotiate additional reporting rights.

Red flag: If a fund claims 100% NAV stability in a turbulent macro environment, question how they’re marking assets. No news is not always good news.

Legal and Structural Risk

The Risk: Even well-structured loans can falter if legal documentation is flawed, collateral is unenforceable, or cross-border complexities interfere. SPVs, if improperly governed, can also expose investors.

Management:

- Use of top-tier legal counsel. Ensure documentation is robust—covering collateral, default rights, guarantees, and jurisdiction.

- Jurisdictional structuring. Loans should be governed by creditor-friendly laws (e.g., Singapore, UK, or New York) even if the borrower is overseas.

- Bankruptcy-remote SPVs. These isolate risk and protect investor assets. Trusted trustees (e.g., DBS) reduce counterparty risk.

- Legal awareness. Managers operating regionally must monitor changes in local regulations (e.g., capital controls, FX restrictions).

Best practice: Always ask if a reputable law firm structured the deal and whether collateral is “perfected” (i.e., legally enforceable).

Macroeconomic and Systemic Risk

The Risk: A broad downturn — rising rates, slowing growth, or external shocks — can simultaneously stress many borrowers. While private credit lacks run-prone liquidity like banks, funds may still gate redemptions or mark down NAVs in adverse conditions.

Management:

- Stress testing. Good managers simulate extreme macro scenarios and adjust exposures accordingly.

- Sector rotation. Stay diversified across recession-resilient sectors (e.g., healthcare, tech infrastructure) rather than cyclical ones.

- Low fund-level leverage. Avoid magnifying losses. Most private credit in Asia is unlevered, which is a positive.

- Macro awareness. Monitor indicators like high-yield spreads or GDP revisions. They’re leading signs of credit risk.

- Portfolio context. Keep private credit as a slice (e.g., 10–20%) of your broader portfolio, not the core.

Regulatory outlook: MAS and global regulators are watching the sector, but Singapore’s structure (no daily redemptions, strong fund governance) helps prevent systemic shocks.

Summary: Risk and Mitigation Table

Final Thoughts

Risk is part of why private credit pays more. But that doesn’t mean it’s reckless - on the contrary, with proper safeguards, it can offer better downside protection than public high-yield bonds. The key is disciplined underwriting, conservative structuring, and informed investing.

Private credit isn’t a black box. The more you understand how it’s built and managed, the more confidently and profitably you can allocate to it.

Next, we’ll shift focus to the future of private credit, particularly its trajectory in Singapore and Asia-Pacific: Where is this asset class heading, and what should investors watch for in the next five years?

Let’s get into it.

{{cta-component}}

Outlook 2025–2030: Retailisation, Tokenisation, and Asia’s Expansion

The next five years will likely redefine private credit’s reach and structure. What was once a niche for institutional allocators and ultra-high-net-worth investors is becoming broader, more tech-enabled, and central to Asia’s evolving capital markets.

Here's how the landscape is expected to shift by 2030:

Gradual Retailisation of Private Markets

Private credit is entering a new phase where it won’t be limited to institutions and accredited investors.

Regulatory signals in Singapore, particularly MAS’s Long-Term Investment Fund (LIF) framework, point toward controlled access for retail investors:

What to expect by 2030:

- Retail-Friendly Fund Launches: MAS may greenlight diversified funds (e.g., LIF-authorised) blending private credit, infrastructure, and private equity. These could become part of retirement solutions, distributed via wealth platforms or banks, with features like partial liquidity buffers, modest lock-ups, and minimum investments in the S$5k–S$10k range — a fraction of today’s accredited-only products.

- Normalisation in Portfolio Allocations: If early funds perform without major blow-ups, private credit could become as common in discussions as REITs. Possibly even CPF Investment Scheme inclusion down the line — speculative, but not off the table.

- Global Shift in Parallel: Singapore isn’t alone — the EU’s ELTIF reforms and U.S. interval funds are on similar paths. By 2030, expect a steady flow of retail-oriented private credit vehicles globally, though allocations will likely remain capped to preserve risk management.

Implication for AIs: While the direct effect may be limited, retailisation can expand exit pathways and product choice, potentially boosting liquidity via funds-of-funds buying secondary stakes in older vintages.

Technology and Tokenisation to Expand Access and Liquidity

Blockchain and smart contract technologies promise to reshape how private credit is administered and traded. Though full decentralisation remains far-fetched, significant steps are likely:

Anticipated Developments:

- Tokenised Loan Portfolios: SPVs could issue blockchain-based tokens representing ownership stakes in loan pools. These tokens may become tradeable on licensed exchanges (e.g., via MAS Project Guardian frameworks), providing mid-tenor liquidity options.

- Smart Contract-Driven Payouts: Interest payments could be automated via code, reducing back-office complexity and improving payout consistency.

- Fractionalisation and Micro-Investment: By reducing administrative burden, tokenisation allows lower ticket sizes (possibly under S$100) which can enable greater inclusion (even though regulatory minimums may still apply).

- Legal and Regulatory Maturity: Singapore is ahead in integrating digital asset regulations with traditional finance. Expect slow but steady legitimisation of tokenised debt as mainstream financial instruments.

Caveats: Cybersecurity, fraud risk, and shallow liquidity remain concerns. Early ecosystems may be gated — e.g., AI-only blockchain exchanges with KYC layers, but the infrastructure is moving.

Asia’s Private Credit Boom: Strong, Diversifying, and Regionalising

Private credit in Asia is only just getting started. Its expansion over the next five years will be driven by both structural and cyclical forces:

Growth Drivers:

- Persistent Funding Gaps: SMEs, real estate, and infrastructure continue to face capital shortages — especially in emerging Southeast Asia. Basel-driven bank retrenchment leaves room for funds to step in.

- Institutional Capital Mobilisation: Sovereign funds, pension funds, and insurance companies (e.g., GIC, Temasek, GPIF, Korean insurers) are upping allocations. Demand for Asia-based exposure from Middle Eastern and Western allocators will also grow.

- Singapore’s Role as a Regional Anchor: With frameworks like VCC and a robust legal ecosystem, Singapore is on track to become Asia’s private credit capital — like Cayman for hedge funds or Luxembourg for UCITS.

- Cross-Border Deal Normalisation: Lending from Singapore into Vietnam, Indonesia, India, and even Mongolia will be standard practice — supported by maturing legal systems and regional credit service providers.

Caution Point: Asia hasn’t had a broad private credit default cycle yet. When one comes, expect a shakeout — weaker players will exit, and survivors will gain market share. This maturation will ultimately benefit long-term participants.

Strategic Innovation in Structures and Offerings

Private credit delivery mechanisms will evolve to reflect investor preferences and economic conditions:

Emerging Trends:

- Perpetual Yield Funds: Open-ended, income-focused funds with soft liquidity (e.g., quarterly redemptions with caps) are becoming more common. These are ideal for investors who want income without committing to decade-long lockups.

- Integration into Digital Wealth Platforms: Robo-advisors and neobanks may offer private credit as a slider allocation. Expect products with no capital calls, automated reporting, and passive participation — much like ETFs, but for private debt.

- ESG and Impact-Oriented Credit: Green private credit funds (e.g., financing solar, EV infrastructure, social housing) will gain traction. MAS is supporting sustainable finance, and blended-finance models (e.g., concessional layers) may expand investor participation while achieving impact.

Market Pressure: Yield Compression and Competitive Sorting

Private credit’s growth will attract competition — and with that, some trade-offs.

Market Dynamics to Watch:

- Spread Compression: As capital floods in, yields on high-quality deals may shrink. A 12% direct loan today might be priced at 8–9% by 2030. Still attractive, but less fat margin for error.

- Flight to Quality: Borrowers will have more financing options. Stronger sponsors can demand better terms, which could push funds to specialise — e.g., in venture debt, structured credit, or second-lien exposures — to maintain yield.

- Improved Credit Standards (Paradoxically): Intense competition might ironically lead to better borrower quality, as only well-run businesses attract multiple bids.

Partial Convergence with Public Markets

Lines may blur between private and public debt markets — especially for larger deals:

- Syndicated Private Loans: Big private deals may start trading informally or through shadow quote systems (akin to how leveraged loans are traded in the US).

- Regulated Secondary Platforms: Digital exchanges or specialist brokers may list select private credit instruments for accredited or institutional investors.

That said, bespoke lending and close borrower relationships remain a defining feature of private credit. The full public market model won’t apply broadly — only at the top end of the capital stack.

Final Word: The Next Normal for Private Credit

By 2030, private credit will be:

- Larger and more systemically relevant

- More tech-enabled and semi-liquid

- More inclusive across the investor spectrum

- More diversified across sectors, countries, and strategies

Singapore is set to be a regional leader, offering the infrastructure, regulation, and talent needed to anchor Asia’s private credit boom. For investors, this means more choice, more flexibility — but also the need to stay informed.

Private credit won’t remain an exotic slice of alternative portfolios. It’s becoming a core building block in the hunt for yield, capital preservation, and portfolio stability.

Whether you’re an accredited investor looking to refine your allocation strategy or a future retail participant watching from the sidelines, the next five years will open up unprecedented ways to participate — responsibly, securely, and intelligently.

Conclusion: Building Income Resilience Through Private Credit

By 2025, private credit has moved from niche to mainstream — and with good reason. In an era marked by uncertainty, volatile public markets, and inflation concerns, private credit offers what many investors crave: steady yield, downside protection, and a level of customisation rarely found in public instruments.

Whether you’re a retiree seeking dependable monthly income, a family office managing multi-generational wealth, or an accredited investor looking for diversification beyond equities and real estate, private credit can play a critical role. Here's why:

Key Takeaways

Enhanced Yield with Monthly Income Potential

Private credit has consistently delivered mid-to-high single-digit returns, and in some cases, low double digits — well above traditional bond yields. That yield premium compensates for illiquidity and credit risk. For investors needing reliable distributions (e.g., retirees or charitable foundations), this steady coupon flow can significantly improve cash flow outcomes compared to a traditional 60/40 portfolio.

Lower Volatility and Portfolio Stability

Private credit isn’t subject to daily market pricing. You won’t see dramatic valuation swings in your portfolio, which helps prevent emotional decision-making during market corrections. In periods like 2022–2023 — when public bond NAVs dropped sharply — private credit portfolios continued paying interest and experienced minimal mark-to-market disruption. That’s powerful for long-term, income-focused investors.

Diversification Through Low Correlation

Private credit returns are driven by borrower-specific outcomes, not public market sentiment. The asset class tends to have low correlation with both stocks and bonds, helping smooth portfolio returns during downturns. Especially in rising-rate environments, floating-rate private loans can even benefit, unlike fixed-rate bonds.

Downside Protection via Collateral and Seniority

Most private credit loans are secured and senior in capital structure, giving investors a claim on assets in the event of borrower distress. Add in covenants and early intervention rights, and you have a robust framework for capital preservation. Historical recovery rates for well-structured senior secured loans are strong — typically 60–80% — limiting worst-case outcomes.

Customisation and Control

Private credit isn’t a one-size-fits-all product. Investors (or fund managers on their behalf) can select sectors, enforce ESG requirements, or tailor covenants — privileges not available in passive bond indexes. This strategic flexibility is akin to getting a tailored suit instead of one off the rack — it fits your portfolio’s needs.

Why It Fits Especially Well in a Singapore Portfolio

Many accredited investors in Singapore already hold substantial positions in equities and property. Private credit offers a complementary, fixed-income-like alternative that generates strong income, yet remains relatively uncorrelated with those exposures. In fact, many local family offices now allocate 10–20% to private credit for precisely this reason — it enhances yield without adding equity-style volatility.

And with platforms like Kilde, access has never been easier. Kilde’s MAS-regulated platform curates deals, ensures robust security measures (like escrow accounts and collateralization), and offers a digital interface that simplifies investment — without sacrificing due diligence. Investors can diversify across multiple private credit notes that were once reserved for institutions, and enjoy monthly income in a user-friendly format.

This is democratisation with guardrails — the deals are curated, the risks are managed, and the entry points are far more accessible than before.

A Word of Caution: Risks Still Matter

None of this implies private credit is risk-free — far from it. As we've discussed throughout this guide:

- Defaults happen.

- Illiquidity is real.

- Valuations can be opaque.

- Macroeconomic conditions can shift quickly.

Which is why prudent investors must diversify, size positions appropriately, stick with reputable platforms, and stress-test scenarios — especially in an environment where defaults could rise from historically low levels.

Yet even in tougher climates, private credit tends to hold its own. When equities are down 20% in a recession, a well-managed private credit fund might still deliver low-to-mid single-digit returns — and that's a win. The key is to think in terms of risk-adjusted resilience, not just maximum return.

Final Thoughts: From Niche to Core Allocation

Private credit is no longer just for institutions or ultra-wealthy investors. It has matured into a reliable, income-producing, and resilient asset class — one that belongs in any thoughtfully constructed portfolio. Whether you want to:

- Replace a portion of underperforming bonds

- Generate monthly income for financial independence

- Build downside protection alongside higher-return equities

...private credit can deliver.

The future of investing is increasingly multi-asset, multi-platform, and multi-strategy — and private credit is firmly part of that mix.

Ready to Get Started?

If you’re an accredited investor in Singapore interested in putting these principles into action, a platform like Kilde offers a practical on-ramp. Regulated by MAS, it provides access to thoroughly vetted, income-generating private credit deals — with strong risk safeguards and a digital interface built for ease of use.

- Choose deals that match your time horizon

- Diversify across borrowers and maturities

- Monitor your income stream easily from one dashboard

But as always: do your homework. Review the underlying deal terms, understand the security, and make sure the liquidity aligns with your needs. The smartest private credit investors treat the space not as a magic bullet, but as a strategic tool — and that mindset is what leads to long-term success.

With clarity, diligence, and the right partners, private credit can be your portfolio’s secret weapon for income resilience and risk-managed growth.

{{cta-component}}

Disclaimer Notice

This page is provided for general informational purposes only and does not constitute legal, financial, or investment advice. Please refer to our Full Disclaimer for important details regarding eligibility, risks, and the limited scope of our services.